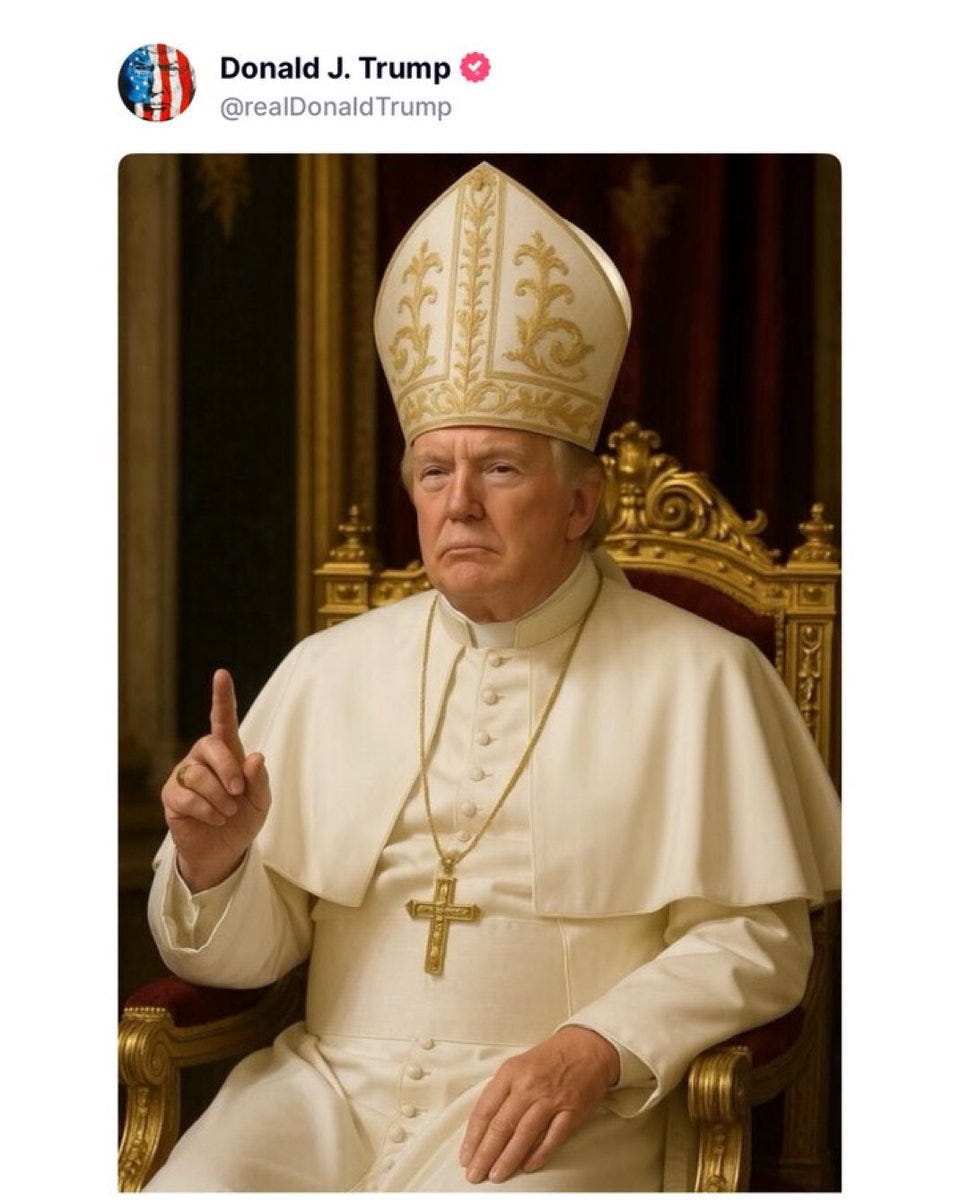

"When Tariffs cut in, many people's Income Taxes will be substantially reduced, maybe even completely eliminated,” Donald Trump claimed yet again last week in a Truth Social post that didn’t get nearly the attention of his self-portrait in the Pope’’s vestments. “Focus will be on people making less than $200,000 a year."

11:07 PM · May 2, 2025·108.3M Views

This contention, like just about everything Trump says about tariffs and taxes, is – of course – false. (Who am I kidding? Just about everything Trump says on any subject is false.) Even setting aside the likelihood that Trump’s tariff schemes will push the economy into a recession, revenues from tariffs can’t come anywhere close to making up for the roughly $2.7 trillion the income tax raises each year. What’s worse, Trump won’t admit – or doesn’t even realize – that his tariffs, which are simply taxes on imports, will fall hardest on people making less than $200,000 a year.

A typical low- to middle-income household would pay another 5.5 percent of their income in tariffs, compared with 1.9 percent for the highest-earning families, according to a March 31 estimate from the Yale Budget Lab.

Many lower income Americans don’t pay any income tax at all, and even those at the middle of the income spectrum often pay less than 5 percent in income taxes. For most Americans their largest tax is to support Social Security and Medicare, which adds up to a little more than 15 percent for the vast majority of wage earners.

Mr. Trump's claim about tariffs lowering taxes amounts to "an argument that says, 'If Americans pay more out of their left pocket, the government will be able to put more in their right pocket,'" Joe Rosenberg, senior fellow at the Urban-Brookings Tax Policy Center, told CBS News.

In fact, if Trump and the Republican Congress currently considering a new tax bill get their way, most Americans – even those who might benefit from Trump’s promise to eliminate taxes on tips – will end up paying a lot more out their left pocket in import taxes without getting any gains in their right pocket.

So what’s really going on? Republicans like to assert that they are the party that wants to cut taxes, while Democrats itch to raise them. But now Trump has undermined that claim by imposing, if he persists with his tariffs, what would be the largest tax increases on record, with the greatest burden falling on those with the least ability to pay.

Many of the adamant MAGA supporters may not realize it, but a lot of people who voted for Trump are in the process of finding out that they are being played as the rubes at the carnival.

Meanwhile, the “one big beautiful bill” that Republicans hope to move through Congress this year won’t actually make your taxes any lower than they are now. But it will enshrine the business and personal tax cuts heavily tilted toward the rich that they approved in 2017, adding at least another $5 trillion over the next 10 years to the already excessive budget deficits that the GOP asserts are a mortal threat to the American way of life. I’ve long been skeptical of the deficit alarmism that has been conventional wisdom in Washington for years. But the truth is, Republicans may now be on the verge of making their supposed greatest fears come true.

With all the drama Trump generates every day, it’s easy to lose track, as Matthew Yglesias wrote recently, of all the damage the Republican-led Congress is struggling to achieve.

Trump won. And now, while a million crazy things are happening in the executive branch, congressional Republicans are moving forward with a fiscal agenda that is incredibly irresponsible and will add trillions in debt, despite DOGE’s efforts to saves pennies through measures like refusing to help Milwaukee address unsafe levels of lead in their public schools’ drinking water.

Republicans are telling some people that there will be trillions of cuts to social safety net programs while promising other people that there won’t. But all possible versions of the GOP fiscal agenda result in huge increases to the budget deficit. In some, those increases are partially offset by cuts to programs for the poor; other times the deficits are just really large.

What we should be doing is aiming for balanced fiscal consolidation: higher revenue and lower spending, while trying to shelter the most vulnerable from the impact of cuts.

But Republicans want to reduce revenue, raise the deficit, and ensure that the pain of budget cuts falls on the vulnerable.

And it won’t just be the most vulnerable Americans who will feel the pain. As Russell Berman writes in The Atlantic, the Republican budget maneuvering poses a real risk of tanking the economy.

The GOP stands virtually no chance of stabilizing the nation’s finances, the Republican economist Douglas Holtz-Eakin told me. The only question, he said, is “how much worse will it be when they’re done?”

For years, fiscal hawks have warned that America’s ever-increasing debt (now more than $36 trillion) will provoke a crisis: Markets will crater and interest rates will spike. Even as both parties have run up the nation’s tab, these doomsday predictions haven’t come true, leading to an unspoken bipartisan understanding that growing the deficit would never really wreck the economy. But Trump’s proposals could shatter that assumption.

“It’s a significant risk,” Mark Zandi, the chief economist at Moody’s Analytics, told me. Enacting Trump’s agenda would probably be a “corrosive event” rather than an immediate disaster, he said, but “there is a reasonable probability that we go over the cliff.” Trump’s aggressive tariffs already prompted a steep sell-off in the bond markets, which analysts monitor for signs that global investors are losing confidence in the U.S. economy. If Republicans explode the debt, Zandi said, “you could see bond investors lose it.”

In addition to making his first-term tax cuts permanent, Trump wants Congress to eliminate a suite of taxes—on tips, overtime pay, and Social Security benefits—while adding hundreds of billions in new spending to secure the southern border and bolster the military. As the fiscal analyst Jessica Reidl observed last month in The Atlantic, the GOP’s budget resolution would, if enacted, add more to federal deficits than the four costliest bills signed by Trump (during his first term) and former President Joe Biden combined.

Is there any way out of this trap? Maybe, but only if Washington is ultimately prepared to raise tax revenues enough to roughly cover the cost of the government programs we currently have, which is about what most Americans actually say they want. That won’t happen as long as Republicans are in control.

Still, one can dream. So it’s worth thinking about what a more fiscally responsible budget would look like. . . a subject I plan to turn to soon in a future Redburn Reads.